Summary

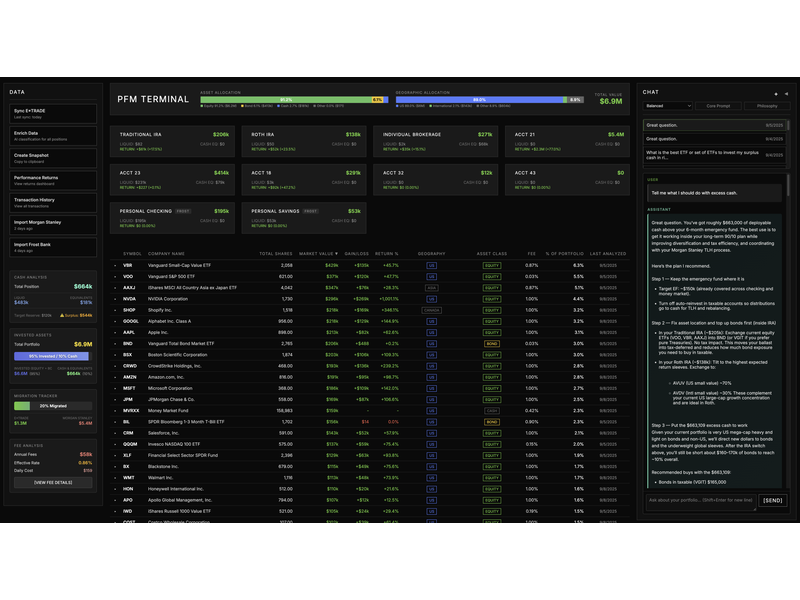

Aggregates two custodians; tracks allocation/fees/cash; supports ETF picks & trade cadence.

Problem Statement

Migrating from an active fund manager to self-managed ETFs is complex due to tax-loss harvesting requirements and the need to maintain proper asset allocation across multiple accounts. Without unified visibility, it’s easy to trigger wash sales or drift from target allocations.

Details

Monitors migration from an active manager to self-managed ETF strategy while honoring tax-loss-harvesting constraints. Shows current vs. target asset/geographic allocation, cash runway, and fee drag; recommends ETF lineups aligned with Ben-Felix/Dan-Rasmussen principles.

Includes trade planner (timing, account routing) and guardrails to avoid wash-sale conflicts during the transition. Used regularly.

Images

What We Learned

Successful financial transitions require both strategic planning and tactical execution tools. Aggregating data from multiple custodians reveals hidden fee drag and allocation drift. Automated wash-sale detection prevents costly tax mistakes. Following a systematic investment philosophy (Ben Felix/Dan Rasmussen) through software guardrails removes emotional decision-making.