Summary

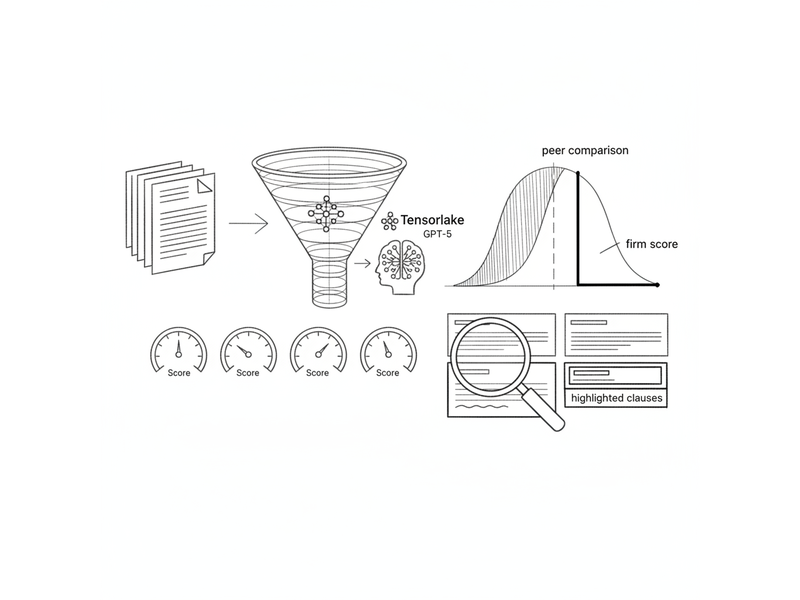

CIM digester for PE: Email/upload CIMs → Tensorlake → GPT-5 → structured metrics + risks/merits; sortable UI & team voting.

Problem Statement

Private equity firms receive dozens of Confidential Information Memoranda (CIMs) weekly, each 50-100 pages long. Manually extracting and comparing financial metrics, risks, and opportunities across deals is time-consuming and inconsistent, leading to missed opportunities.

Details

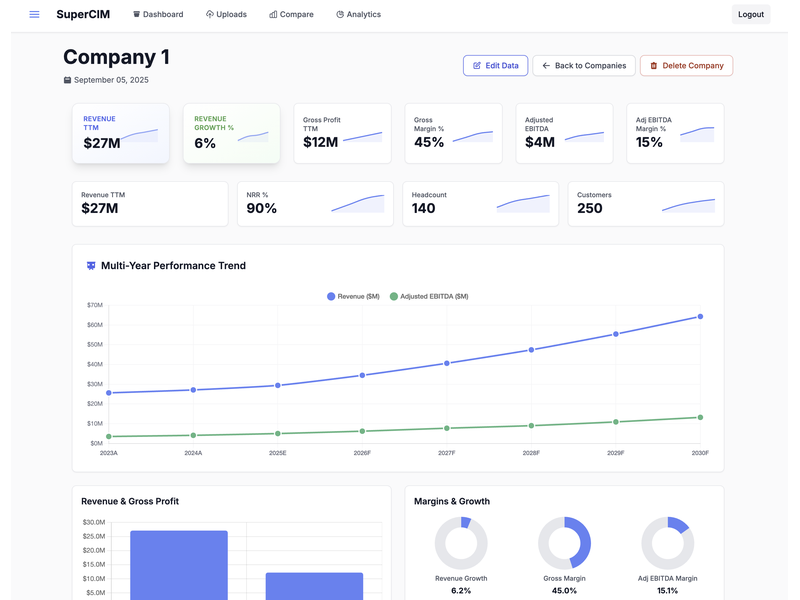

Converts CIM PDFs to markdown (Tensorlake), then extracts financial history (revenue/EBITDA, growth, margins), market notes, merits/risks, and key KPIs via GPT-5.

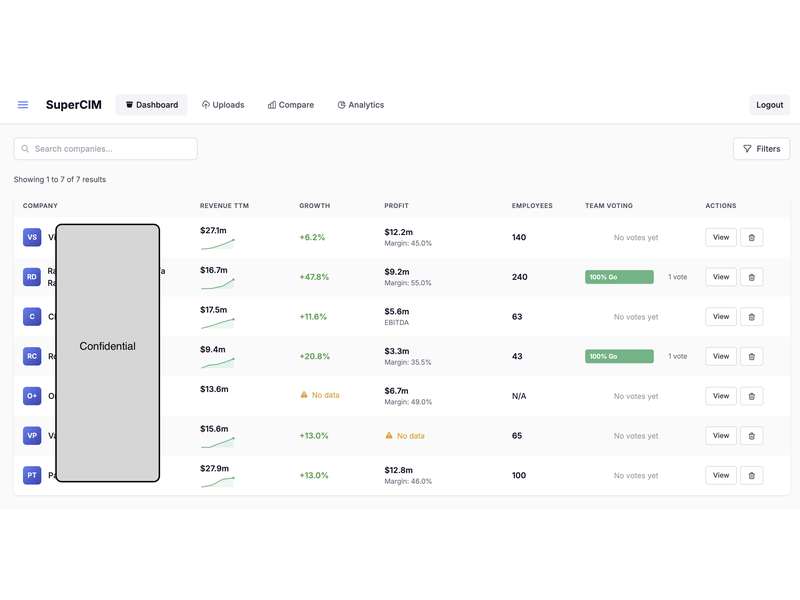

UI supports sorting/filtering, tagging, and team voting to triage the pipeline. Roadmap includes cohort benchmarking and automatic Q&A across the deal room.

Images

What We Learned

Tensorlake + GPT-5 can reliably extract structured financial data from inconsistent PDF formats. Standardizing CIM data enables apples-to-apples comparison across deals. Team voting features help surface consensus and disagreement early in the evaluation process. Email forwarding is the lowest-friction ingestion method.